Updated: 2008-11-25

By Zhou Yan (China Daily)

A proposal made by NDRC, to be discussed at the Central Economic Work Conference in early December, will see the central government pump 300 to 400 billion yuan into the capital market. This accounts for nearly 10 percent of the market capitalization on China's two bourses and is seen as a move to lift sagging investor confidence, an anonymous source, involved in drafting the plan, was quoted by The Economic Observer as saying.

However, analysts expressed their doubts on the effectiveness of the injection plan as the market is still reeling from global economic woes and the lackluster performance of listed companies.

"I don't think it is useful if the fund is created specifically to support stock prices, as it does not address the structural reasons why the Shanghai market performs poorly," said Arthur Kroeber, managing director of Beijing-based consultancy Dragonomics.

Wu Feng, an analyst at TX Investment Consulting Co Ltd, said the proposed 400 billion yuan fund was more like a stabilization fund, over which concerns still persist and hence may be difficult to put in place soon.

"Without further details I would be surprised that the NDRC is looking at a direct funding injection in the stock markets, particularly, since the market already appears to be consolidating and trading in a range," said Lorraine Tan, vice-president of Asia-Pacific equity research for Standard & Poor's.

"Most of the government injections are only effective in that they discourage short-sellers, like what the Hong Kong government did while creating the Tracker fund during the Asian crisis. Such moves do not necessiate changes in the fundamental situation over the mid term although they may provide a short-term boost," Tan said.

Kroeber, however, said that if the proposal was to create a long-term fund with an independent investment objective, such as funding pensions, then it could play a role in creating a healthier market.

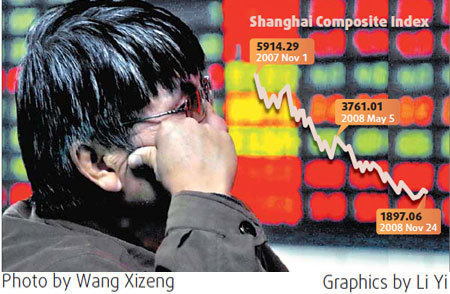

The benchmark Shanghai Composite Index sank 3.67 percent to 1897.06 points yesterday in the absence of the long-anticipated interest rate cut during the weekend.

No comments:

Post a Comment