(China Daily) NEW YORK – The United States and China kicked off what is likely to be a global round of interest rate cuts, part of a barrage of measures deployed around the world to fight a deep economic slowdown.

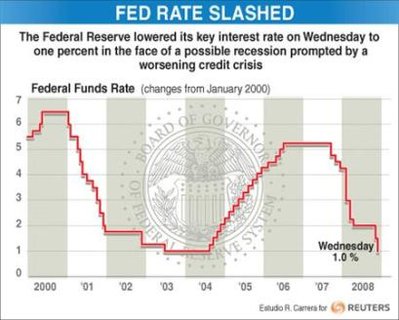

The US.Federal Reserve cut rates by 1/2 a percentage point, in line with most analysts' forecasts. [Agencies] |

Norway also cut interest rates on Wednesday and Britain indicated it may lift self-imposed limits on government borrowing to counter a recession that stems from the financial crisis triggered by the collapsed US housing bubble.

Japan may cut rates on Friday and the European Central Bank and Britain are expected to add to the monetary easing next week as authorities remain fearful that the worst financial crisis in 80 years will cause a long global recession.

US regulators are putting the final touches on a new federal program that could provide up to $600 billion in government guarantees of home mortgages to help prevent foreclosures, a source familiar with the talks said. The government hopes to announce the program as soon as Thursday, the source said.

The International Monetary Fund approved an emergency short-term liquidity facility for emerging market economies to help them weather the credit crisis.

The US Federal Reserve cut rates by 1/2 a percentage point, in line with most analysts' forecasts.

The Fed said the pace of US economic activity appeared to have slowed markedly and it expected inflation to moderate as a result of lower energy and commodities prices.

Major US stock indexes rallied more than two percent before falling back to close lower. Analysts said the rate cut had already been priced in and the outlook remains grim.

"Bigger picture, I don't think anyone believes that any interest rate cuts are going to affect the underlying issues surrounding mortgage-related and consumer-related credit," said Chip Hanlon, president of Delta Global Advisors in Huntington Beach, California.

China, increasingly appearing to be the world's last engine of economic growth, cut banks' benchmark lending and deposit rates by 0.27 percentage point on Wednesday, the third cut in six weeks, to prop up consumption and bolster the growth of its economy on the face of worsening global economic slowdown.

The benchmark one-year deposit rate would drop to 3.60 percent from 3.87 percent, while the benchmark one-year lending rate would fall from 6.93 percent to 6.66 percent.

The move would become effective on October 30.

Analysts say the move is aimed to reduce borrowing costs of enterprises, propel domestic investment, and it will also be conducive for theequitymarket.

The Chinese economy has been slowing down over the year due to weaker overseas demand and a slump of the real estate sector. The nation's GDP growth decelerated for 9 percent in the third quarter, the first time in single digit in five years.

The central bank also cut interest rates and reserve requirements on September 15 and October 8. The latter move coincided with rate cuts by leading central banks around the world.

Norway's central bank cut rates by half a percentage point to 4.75 percent, signaling more moderate cuts ahead to help shield the oil-fueled economy from the crisis.

WORLD STOCKS RISE, DOLLAR DOWN

The interest rate cuts, and expectations of action in the United States, lifted world stock markets and sent the US dollar plunging, sparking a 7 percent surge in oil.

Japan's Nikkei index ended up 7.7 percent and European shares climbed 7.5 percent.

Wall Street followed Tuesday's 10 percent rally, its second-biggest rise ever, with a volatile day. The Dow ended down 0.82 percent and the S&P 500 fell 1.11 percent, reversing a rally after the Fed cut.

The former head of the US National Bureau of Economic Research, Martin Feldstein, was quoted as saying the United States has entered a recession that will last longer and do more damage than any other since World War Two.

Economists expect US GDP figures on Thursday to show a 0.5 percent decline in July-September, according to the median of forecasts in a Reuters poll, and many see that as the start of a contraction lasting at least nine months.

Two of the largest US auto parts makers, BorgWarner Inc and Tenneco Inc, said the crisis would mean more job cuts and plant closings.

As the US presidential campaign hit the final stretch before the November 4 vote, Republican John McCain questioned Democratic rival Barack Obama's readiness for the White House, saying he would be bad news for small business.

Obama, who polls show is trusted more on the economy by voters, said McCain's policies would hurt the middle class.

British finance minister Alistair Darling said Britain is moving into recession and the government will need to spend more and forget about its self-imposed limits on borrowing for the time being.

EYES ON JAPAN, EUROPE NEXT

The Bank of Japan will consider cutting rates on Friday but will watch market conditions before deciding, a source with knowledge of the matter told Reuters.

The European Central Bank and the Bank of England are expected to ease policy at their regular meetings next week. The ECB is expected to cut a half point off rates to 3.25 percent, according to a Reuters poll.

Governments have pledged about $4 trillion to support banks and restart money markets to try to stem the crisis set off by the bursting of a bubble in the US housing market.

There were more signs that the acute financing difficulties were easing. The closely watched rates that banks charge each other to borrow dollars fell again as central banks continued to inject extra liquidity into the system.

As credit lines have dried up, a growing number of governments have had to look for help from global lenders.

The IMF, European Union and World Bank agreed to a $25.1 billion economic rescue package for Hungary.

Ukraine, Belarus, Pakistan and Iceland are also in various stages of seeking, securing or considering IMF help.

South Korea denied speculation it was seeking IMF support but said it would ease won liquidity requirements on banks to help bring down their funding costs.

IMF officials have said the fund may need additional resources in a prolonged crisis and European Commission President Jose Manuel Barroso said on Wednesday China and the Gulf countries could do more to help the IMF support countries hit by the financial crisis.

The US Federal Reserve established four new currency swap lines with Brazil, Mexico, South Korea and Singapore, to ease dollar funding shortages.

No comments:

Post a Comment