Updated: 2008-12-09

(Agencies/China Daily) Progress toward an auto bailout and hopes for massive public works injected life into US equity markets on Monday despite distress signals including new corporate job cuts and a pillar of American media filing for bankruptcy.

Chinese and European leaders plotted their next steps as investors looked to governments to lead major economies out of recession because central banks could start running out of room to cut interest rates further.

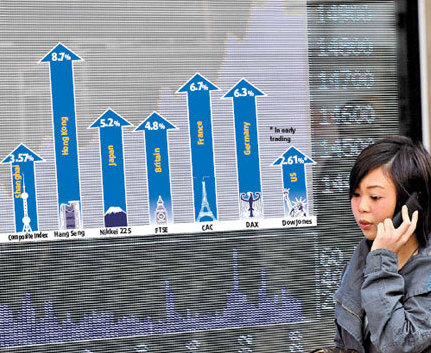

A woman walks past a board displaying the Hang Seng Index chart in Hong Kong, December 8, 2008. Hong Kong share prices closed 8.7 percent higher, lifted by hopes that Beijing would announce more market-boosting measures to boost its economy. The benchmark Hang Seng Index rose 1,199 points at 15,044. Stocks on the mainland and other Asian markets also rose. [Agencies] |

China's Central Economic Work Conference

China's top policymakers gathered to map out economic policy for next year, with the government focusing on shoring up growth and jobs as export demand shrinks.

The annual Central Economic Work Conference started Monday in Beijing in a closed session likely to last three days to discuss ways to keep the country's annual growth at 8 percent or higher.The Chinese government is "very likely" to initiate cuts in business tax to add impetus to the slowing economy. [Tax cuts for businesses in pipeline]

The authorities may soon cut business tax for enterprises by 1 percentage point from the current 5 percent, a source close to policymakers told China Daily, without mentioning a timeframe.

That would amount to 120 billion yuan ($17.5 billion) worth of tax cuts given annual business tax revenues of more than 600 billion yuan ($87.6 billion) last year.

Business tax - distinct from enterprise income tax and value added tax - is levied on enterprises and individuals that provide labor services, transfer intangible assets or sell immovable property in China.

|

|

It was also reported earlier that policymakers would introduce more measures to spur consumption at the meeting.

"As demand for exports and the momentum for fixed-asset investments looks set to slow, China's authorities are expected to push forward measures to rebalance the sources of economic development in favor of consumption," Jing Ulrich, managing director and chairman of China equities at JPMorgan, said on Monday.

Policymakers may discuss raising the threshold of personal income tax from 2,000 yuan to 3,000 yuan a month, as the economic slowdown and a slump in property and stock markets have already hit income growth, forcing consumers to cut expenditures.

Meanwhile, some economists suggested that health and education services be expanded to low-income households and unemployment allowance be increased to help ease social pressure and increase consumption.

The Chinese government is also expected to increase social programs in the countryside, which could help boost rural consumption.

Auto Rescue Nears & Obama Infrastructure Plan

US President-elect Barack Obama provided some hope with a weekend pledge to create more than 2.5 million new jobs by 2011 and launch the largest investment in US infrastructure since the 1950s.

"Obama looks like he's going to be able to fast-track one of the largest infrastructure spending packages since the history of mankind," said Arthur Hogan, chief market analyst at Jefferies & Co in Boston.

Negotiators for outgoing President George W. Bush, who hands over power to Obama on January 20, and Congressional Democrats edged toward agreement on a $15 billion auto sector rescue plan after three days of talks.

US Rep. Barney Frank, a Massachusetts Democrat and chairman of the House Financial Services Committee, said the remaining disagreements could be resolved in a few hours.

A draft Democratic plan called for the appointment of at least one car czar to oversee the rescue plan and it set terms for a 7-year loan.

European carmakers focused on consolidation, with Italy's Fiat saying it is too small to survive on its own and Sweden reportedly considering a rescue package for Ford-owned Volvo and General Motors-owned Saab.

The US talks gained urgency after Friday's US employment data showed more than half a million jobs were lost in November.

Dow Chemical Co said on Monday it will cut 5,000 jobs, divest businesses and close plants less than a week after US rival DuPont announced its own cutbacks.

The corporate world was also rocked when the Tribune Co -- the privately held publisher of the Chicago Tribune and Los Angeles Times -- filed for Chapter 11 bankruptcy protection, exposing unsecured creditors including subsidiaries of JP Morgan Chase and Merrill Lynch.

Price is Right?

With the Dow industrials down more than 30 percent this year, some investors were choosing the present to begin a long-term equities strategy.

|

|

The Dow gained 3.5 percent on Monday, briefly trading above 9,000 points, and the S&P 500 closed 3.8 percent higher. European shares gained 6.9 percent and Japan's Nikkei 225, 5.2 percent.

One of the largest US money managers on Monday said US stocks have broken their downtrend and will trade in a narrow range for as long as four months.

But Robert Doll, the global chief investment officer of equities at BlackRock Inc, also told the Reuters Investment Outlook Summit that financial shares will likely underperform for possibly years to come.

Another summit speaker, legendary hedge fund manager Michael Steinhardt, said, "I think now would be a good cyclical time to go into equities, wouldn't you?"

He said that while he didn't think the markets had yet hit bottom, "it wouldn't shock me if it were the bottom."

EU Summit

A European Union summit in Brussels on December 11-12 will study European Commission proposals to give the sagging economy a sharp boost with a 200 billion euro ($250 billion) spending plan.

The European Central Bank cut rates by a record 75 basis points to 2.5 percent last Thursday and economists expect another reduction in January.

The US Federal Reserve has less room to maneuver as its Open Market Committee has trimmed its benchmark lending rate to 1 percent and market players anticipate a reduction to 0.5 percent or even 0.25 percent at the December 15-16 policy meeting.

No comments:

Post a Comment